Corporate Governance

Suzuken’s basic philosophy regarding corporate governance

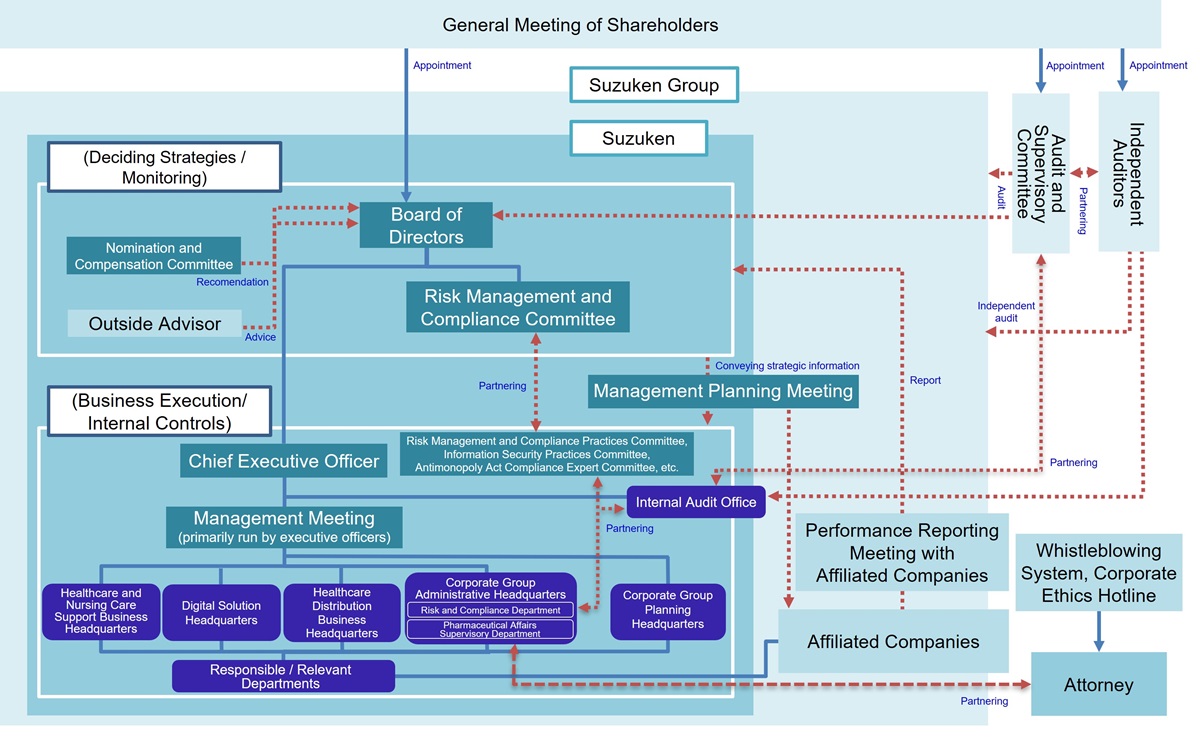

The Suzuken Group positions the strengthening of corporate governance as an important theme of management. Moreover, through efforts focused on strengthening our managerial systems, strengthening our risk management systems, and promoting disclosure and accountability, we endeavor to increase stakeholder trust in our group and achieve our continued and sound development.

State of corporate governance

Corporate Governance Report (529KB) Report date : June 25, 2025

Strengthening our management framework

Suzuken employs a system in which the directors are responsible for the overseeing management and the decision-making process, while the executive officers are responsible for carrying out business operations. We have terminated the retirement benefit system for executives, reduced the number of directors, and established a compensation system for executives that is linked to the company's performance and each individual's contributions.Additionally, to enhance corporate governance by strengthening the oversight and checking functions of the Board of Directors, we transitioned to a Company with Audit and Supervisory Committee in June 2021.

Regarding the management structure of our subsidiaries, we supervise and audit the performance of their executives and employees. The primary measures include dispatching members from Suzuken to serve as directors and auditors of the subsidiaries, establishing systems for reporting and decision-making approval to Suzuken in compliance with affiliated company management rules, and periodically auditing subsidiaries through auditors of Suzuken's Audit and Supervisory Committee, Internal Audit Office, and accounting auditors. Furthermore, Suzuken has established and provides guidance on appropriate internal control systems, considering the unique characteristics of each subsidiary.

In addition, to strengthen Group governance, we practice Group-centered management by implementing a system in which the executive function and audit function each perform their separate roles while also working in close cooperation.

-

※The committees are not committees as legally defined.

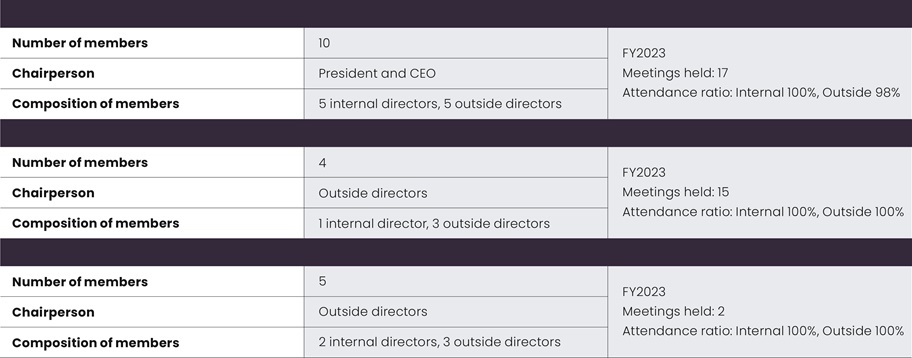

Board of Directors

The Board of Directors examines important matters and reaches decisions in accordance with laws and regulations, the Articles of Incorporation, the Board of Directors Rules and other internal rules. The board also oversees the performance of the directors and executive officers.

To ensure that directors’ decisions are proper and verify the legality and suitability of how they perform their duties, four Audit and Supervisory Committee members (including three outside directors) attend all meetings of the Board of Directors. At board meetings, these four individuals express their opinions and perform supervision and oversight from many perspectives.

Audit and Supervisory Committee

The Audit and Supervisory Committee meets once each month, in principle, and holds other meetings as required.

Audit and Supervisory Committee members attend meetings of the Board of Directors and other important meetings. Attendance is based on Audit and Supervisory Committee audit standards prescribed by the Audit and Supervisory Committee and the fiscal year audit policy and audit plan. In addition, these members receive information about the performance of duties from directors, executive officers, the internal audit division, and other units, and they also check documents concerning important decisions and other documents. Furthermore, responsibilities include audits at the head office, major business sites, and subsidiaries concerning operations and assets and the proper establishment and operation of compliance, risk management, and other internal control systems. Reports are also received from subsidiaries as required.

In addition, to reinforce the monitoring function, Suzuken has appointed three outside directors as Audit and Supervisory Committee members. These outside directors consist of an expert in law, an expert in accounting, and a person with experience in business management. We have also appointed one internal director with extensive knowledge and experience in the Company’s business, gained through many years of involvement in compliance, pharmaceutical affairs, and internal control.

Nomination and Compensation Committee

To discuss nomination and compensation for the directors, executive officers, associate directors, and trustees, the Company has established the Nomination and Compensation Committee comprising a total of five members, which consists of one representative director, one internal director and three outside directors, who are appointed by the Board of Directors. The majority of the committee members are comprised of outside directors, for the purpose of ensuring the transparency and objectivity of the nomination and compensation. The chairperson of the committee is appointed by the Board of Directors from among the committee members, and since June 25, 2024, an outside director has been serving as the chairperson.

This committee was not established in accordance with any law or regulation.

Corporate governance highlights (FY 2024)

| Organizational form |

Company with Audit and Supervisory Committee System |

|---|---|

| Term of directors | 1 year |

| Implementation of an executive officer system | Yes |

| Implementation of performance-based compensation system | Yes |

| No. of Board of Directors meetings | 17 |

| No. of Audit and Supervisory Committee meetings | 15 |

Board composition

The Company’s Board of Directors is held, in principle, once a month and practices swift, efficient decision-making. Board members have been chosen without regard to factors such as gender or age, and they include internal directors with a wealth of knowledge and experience regarding the Company’s businesses, as well as outside directors with exceptional expertise and insight. The Board’s composition, therefore, is characterized by diversity and appropriate size (limited to a maximum of 14 members as stipulated in the articles of incorporation, including nine or less directors, but not directors who are Audit and Supervisory Committee members, and five or less directors who are Audit and Supervisory Committee members), and the Board considers multiple perspectives in making decisions and in overseeing and monitoring business activities. Outside directors account for half the members of the Board of Directors.

We also have a robust system for oversight and monitoring by the Audit and Supervisory Committee. Audit and Supervisory Committee members include an experienced company manager, an attorney with exceptional professional expertise, and a certified public accountant.

Additionally, each outside director has no special interest in the Company and is designated as an independent officer.

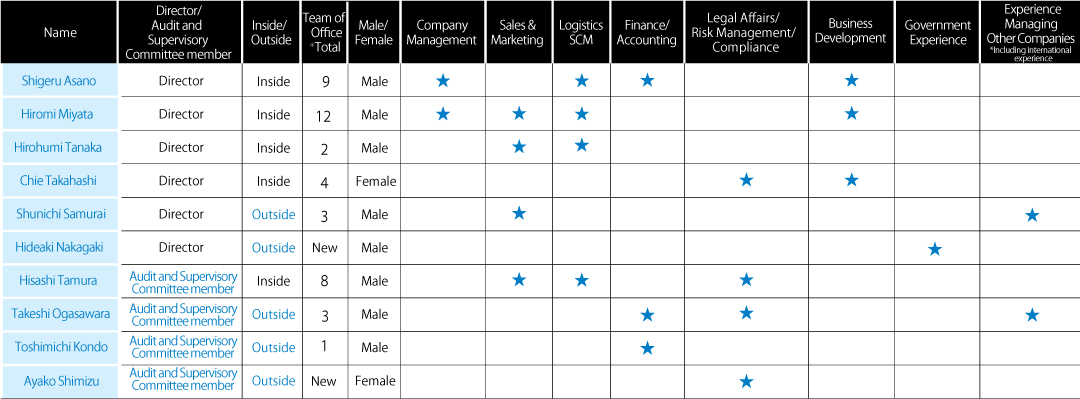

(Reference) Skill matrix for directors (excluding directors who are Audit and Supervisory Committee members) and directors who are Audit and Supervisory Committee members

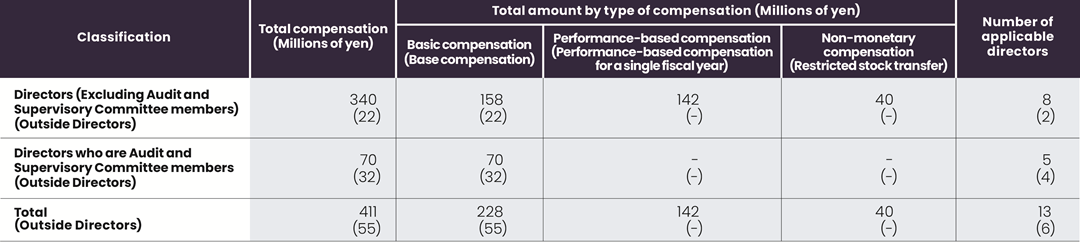

Elements of director's compensation

The Board of Directors established policies for the individual compensation of directors in its meeting held on June 13, 2016.

Regarding the determination of directors’compensation, we have implemented a comprehensive performance evaluation system based on the principles of transparency, fairness, and achievement motivation, using performance indicators for the entire company and for the areas under the responsibility of individual directors. This system is based on the Director, Executive Officer, and Associate Director Evaluation Bylaws and the Director, Executive Officer, and Associate Director Compensation Bylaws. To ensure objectivity and transparency, the Nomination and Compensation Committee, which advises the Board of Directors and has a majority of its members composed of outside directors, deliberates on compensation amounts and submits its opinions to the Board of Directors, which respects these opinions in making its decisions.

The compensation system consists of two components: fixed compensation and performance-based compensation. This system applies to directors excluding the outside directors, who receive only fixed compensation. Within the compensation structure, performance-based compensation is set at a high level to reflect earnings results. Fixed compensation consists of three categories: representative director compensation, director compensation, and executive officer compensation. Performance-based compensation is divided into two types:performance-based compensation for a single fiscal year, which is a short-term incentive, and restricted stock transfer(RS), which is a medium- to long-term incentive. Furthermore, performance-based compensation for a single fiscal year includes two sub-types: individual performance evaluation compensation, determined by one’s performance evaluation, and ordinary income-based compensation, determined by multiplying the consolidated ordinary income by a certain percentage.

For the compensation levels and the compensation system, we refer to the results of an executive compensation survey conducted by an external professional investigative body on companies with the same level of market capitalization as Suzuken. For fiscal 2024, the total compensation for directors was as shown in the table below.

-

※Based on a resolution at the 75th general meeting of shareholders held June 25, 2021, Suzuken transitioned the Company to a Company with Audit and Supervisory Committee System, effective on that date.

Cross-shareholdings

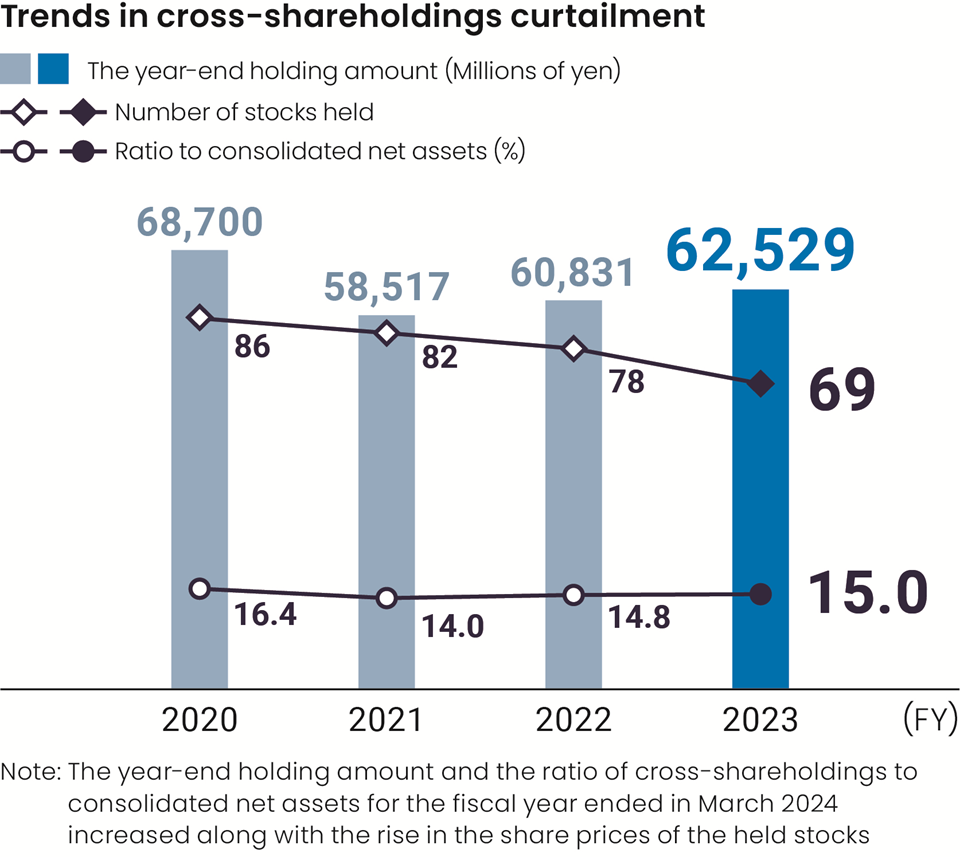

Suzuken's basic policy on cross-shareholdings is to hold shares in companies that contribute to the enhancement of corporate value as a means of building, maintaining, and strengthening transactional and collaborative relationships. The Board of Directors examines individual cross-shareholdings to determine whether they are appropriate.

If a company's shares are deemed unlikely to contribute to corporate value enhancement, we sell them appropriately, considering factors such as timing.

Regarding the reduction in cross-shareholdings, we announced a policy in May 2021 and are continuing to apply it in the medium-term management plan.

In the current medium-term management plan, we have set a policy to reduce cross-shareholdings to 10% or less of consolidated net assets by the end of the fiscal year ending March 31, 2026. As part of this effort, in the fiscal year ended March 31, 2025, we have reduced approximately ¥13 billion across eight brands (including pharmaceutical companies and the Misonoza Theatrical Corporation), and we will continue to work toward this goal.

Since announcing the above policy, we have reduced the number of cross-shareholdings by 33 (including divesting some) for a reduction of approx. ¥35.2 billion.

In exercising its voting rights related to cross-shareholdings, the Company makes a comprehensive judgment based on whether or not the proposal will lead to the increase of its corporate value in the medium-to long-term, and whether it will lead to shared benefit for the shareholders of the company concerned.

Increase in PER

Enriching our communication with investors and our information disclosure

Along with actively conducting IR activities, we will also enrich our English-language disclosures. In fiscal 2023, in order to strengthen our approach to investors with whom we previously had no contact, we increased the frequency of our communication activities by about 30% compared to fiscal 2022. In light of the increase in dialogues with investors about the Suzuken Group’s sustainability initiatives, as well as heightened social demands and interest in ESGs and SDGs, we will also strengthen the disclosure of our non-financial information and communication about our efforts to address social issues through our businesses.

Major communication activities in fiscal 2024

- Dialogues with domestic and overseas institutional investors:60 companies (total 83 times)

- Briefings for analysts and institutional investors: 2 times

- Briefings for individual investors:Conducted since 2007 (participation in the Nagoya Stock Exchange IR Expo)

- Briefings for overseas investors:Participated in conferences for institutional investors hosted by securities companies

- Publication of IR information on Suzuken’s website(https://www.suzuken.co.jp/en/ir/)